- Roland’s Riff

- Posts

- Why Your Margins Aren’t Improving

Why Your Margins Aren’t Improving

How the Best Firms Raise Margins Quietly

TL;DR: Margin expansion right now isn’t about cost cutting or big price hikes. It’s about control, over pricing defaults, scope, utilization, labor mix, and who owns margin decisions. The highest-ROI moves are quiet, executable in 30–90 days, and non-disruptive. Teams that treat margin as an operating system, not a finance metric, are pulling away fast.

Quick note: Today’s post is a bit longer than usual.

That’s intentional. This one goes deeper and gets more actionable than a typical scan-and-scroll read.

Margin Expansion Isn’t About Cost Cutting. It’s About Control.

Most founders think margin expansion is a finance problem.

It isn’t.

It’s a leverage problem, specifically, who controls pricing, scope, labor, and time inside the business. The companies quietly expanding margins right now aren’t doing anything dramatic. They’re not raising prices across the board or slashing headcount.

They’re tightening control in places most founders barely look at.

What follows isn’t theory. It’s a pattern showing up repeatedly across services businesses executing margin improvements in 30–90 day windows, without disrupting demand, culture, or growth.

The Quiet Repricing Nobody Announces

One of the most effective moves right now is raising prices without “raising prices.”

Teams are tightening price architecture instead of making public increases. Wide discretionary ranges are being narrowed. Minimum engagement fees are being enforced quietly through quoting tools. Exceptions still exist but now they require intent, not habit.

At the same time, teams are introducing micro-surcharges tied to behavior, not customers. Rush work. Off-cycle reporting. Weekend service. Custom data pulls.

Customers rarely push back, because the fees are legible.

The result is subtle but powerful: margin improves, demand becomes better shaped, and chaos decreases. Nothing “feels” more expensive, but the economics change meaningfully.

Packaging Is Where Most Margin Leaks Start

Customization feels customer-friendly. Operationally, it’s a tax.

High-performing teams are enforcing a single default package that fits the majority of clients. It’s pre-selected in proposals. Deviations require justification. Add-ons exist — but they’re additions, not substitutions.

Behavior does the rest. Most buyers accept the default.

At the same time, teams are de-bundling senior labor from base offerings. Strategy sessions, senior reviews, and analytics work are being pulled out and sold explicitly. This does two things at once: it protects senior capacity and lets customers self-select into margin.

The non-obvious insight here is that packaging discipline isn’t about saying no.

It’s about deciding where margin lives.

Utilization Is Inventory, Treat It That Way

Most services firms talk about utilization annually or monthly.

The teams winning right now treat utilization like inventory with a shelf life.

They run weekly reforecasts, looking four weeks out, and rebalance staffing immediately when dips appear. Hiring freezes aren’t reactive, they’re automatic below utilization thresholds.

Even more interesting: pricing is being adjusted based on utilization. When teams are over capacity, prices rise selectively. When under capacity, discounts are targeted — not blanket.

This aligns pricing with reality instead of hope.

And it works because it treats labor capacity as a scarce asset, not a sunk cost.

Labor Leverage Comes From Role Design, Not Just AI

AI is helping, but not in the ways most founders expect.

The biggest gains are coming from role compression, not headcount reduction. Overlapping roles are being collapsed. Clear “do vs review” boundaries are enforced. Senior time leakage drops fast.

At the same time, firms are building elastic labor benches. Instead of hiring ahead of demand, they maintain small pools of vetted contractors used only during spikes. Fixed costs fall. Variable costs increase, by design.

This isn’t austerity. It’s control over the cost curve.

AI That Actually Improves Margin

The AI that moves margin isn’t experimental.

It’s boring.

Teams are using AI as first-draft labor, reports, analyses, client updates, with humans refining and approving. Non-billable prep time collapses. Junior productivity jumps. Margins follow.

Some are going further, using AI to smooth staffing and scheduling based on demand signals.

Fewer fire drills.

Less overstaffing.

Better morale.

The pattern is consistent: AI works when it reduces friction, not when it adds novelty.

The Real Shift: Margin Ownership

Perhaps the most important change isn’t tactical at all.

High-performing firms are assigning margin owners, not revenue owners. Each service line has a single accountable owner for contribution margin, reviewed weekly, not buried in monthly finance decks.

Once margin is visible and owned, behavior changes immediately. Low-margin work gets repriced or exited. Capacity gets redeployed. Decisions speed up.

Many firms are also aggressively sunsetting the bottom 10% of clients or services by margin. That move alone often produces immediate relief, not just financially, but operationally.

Capacity is finite. Low margin crowds out high margin.

The Pattern Behind All of This

Across firms benchmarked by top strategy consultancies, the same behaviors repeat:

They are relentless on scope.

Dynamic on pricing.

Weekly on utilization.

Explicit on margin ownership.

None of this is flashy….All of it compounds.

If You Do One Thing After Reading This

Don’t try to implement everything.

Instead, do this one 45-minute exercise:

Pull your last 20 completed projects, clients, or jobs and sort them by contribution margin, not revenue.

Now answer three questions, honestly:

Which 10–20% created the most delivery friction relative to margin?

(Custom scope, senior time leakage, constant exceptions.)Which behaviors went unpriced?

(Rush requests, off-cycle work, “quick favors,” custom reporting.)Where did margin disappear because no one owned it?

(Sales optimized for close rate, delivery optimized for heroics, finance optimized too late.)

Then make one change this week:

enforce a default package,

add one behavior-based surcharge,

or explicitly assign margin ownership to a single person.

Not permanently.

Just as a 30-day test.

If margin improves and chaos drops, you’ve found leverage.

If nothing changes, you’ve learned where not to look next.

Either way, you’re no longer guessing.

Want more than just the weekly deep dives? On Instagram we share quick tips, behind-the-scenes looks, and first access to what’s coming next.

📲 Follow @RolandFrasier on Instagram and join the community.

Thinking About Exiting Your Business?

You’ve built something incredible, now it’s time to make sure you get the most from your exit. We’ve helped countless entrepreneurs maximize their business sales, ensuring they walk away with more than just a deal, they walk away with the best deal possible.

Want to see what’s possible for you? Schedule a complimentary call (click here) today to see how I can help you get the most out of your exit.

Whats Going On Recently

Keep More Of Your Money: PRIME can show you how to protect yourself, grow assets, build business funding, and how to take advantage of 250+ unique tax deductions. Schedule Your Strategy Session Here

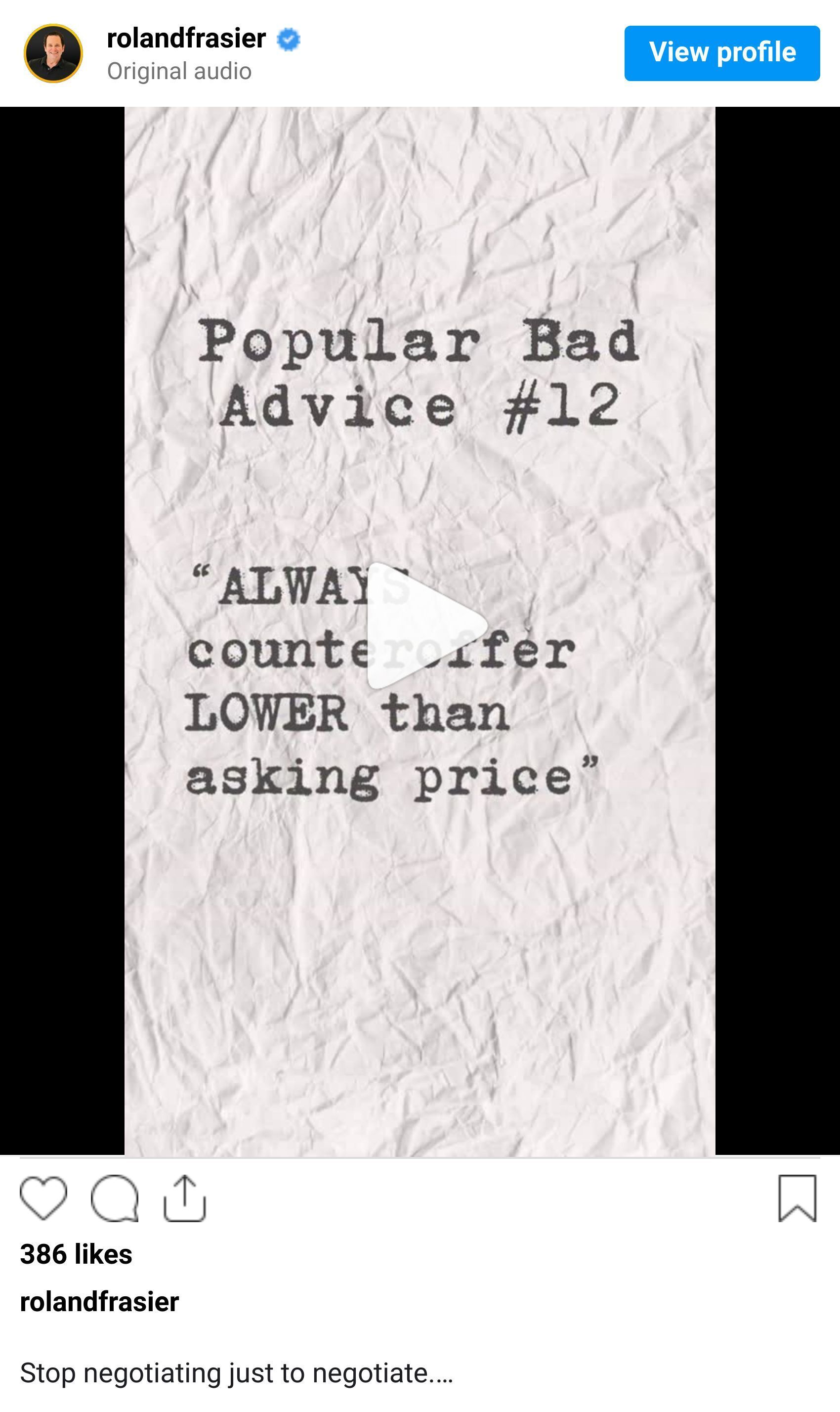

Stop negotiating just to negotiate.

The best deal isn’t always the one where you paid the least, it’s the one where you recognized real value and acted on it.

While others are playing games at the negotiation table, smart investors are closing deals.

Know the difference between strategy and ego!