- Roland’s Riff

- Posts

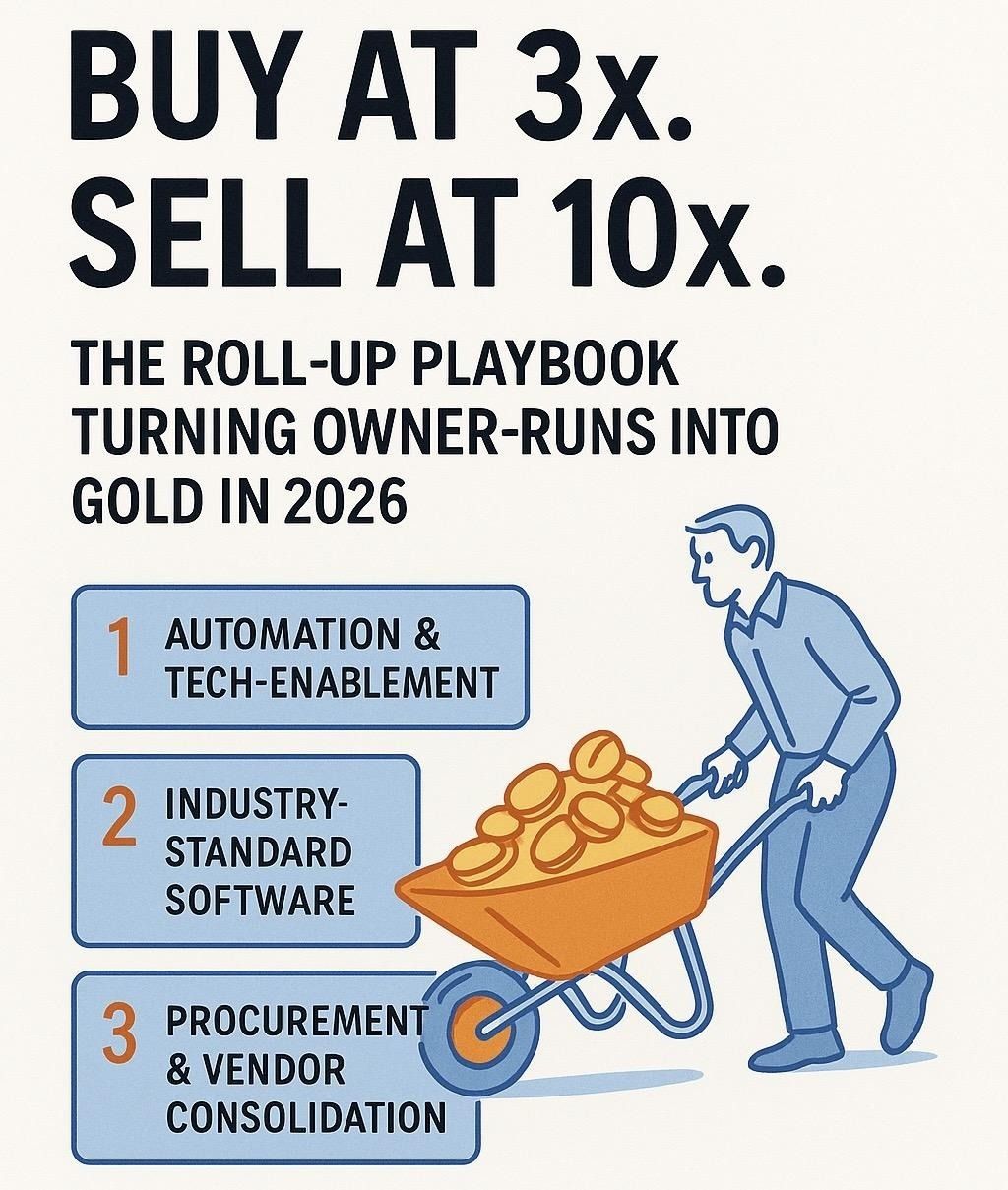

- Buy at 3×. Sell at 10×.

Buy at 3×. Sell at 10×.

The 2026 Roll-Up Play Every Operator Should Steal

TLDR: The Big Opportunity: Buy owner-operated businesses at 3-5x EBITDA, add basic systems and automation, then sell at 10x+ as a professionalized platform. This arbitrage opportunity exists because millions of baby boomers are selling inefficient businesses that haven't embraced modern tech. The Play: Buy a platform company → Acquire smaller add-ons cheap → Integrate with automation, enterprise software, and consolidated purchasing → Sell the combined entity at premium multiples. Result: 35-45% annualized returns. Why Now: SBA loans cover 90% of acquisition costs, PE firms are hungry for professionalized platforms, and the window is closing as more operators catch on to this strategy.

Buy at 3×. Sell at 10×. The 2026 Roll-Up Math Every Operator Should Steal

When I bought my first owner-run company at three times EBITDA, that’s Earnings Before Interest, Taxes, Depreciation, and Amortization, I realized something…

I wasn’t buying a business. I was buying inefficiency.

The opportunity to buy inefficiency at low multiples, tame the chaos and expand margins and multiples has never been as great as it is right now.

Millions of baby-boomers and burnt-out business owners who never embraced AI, industry defining software and systems automation, or consolidated supply purchasing are out there wanting to sell their businesses.

You can profit from it using the same math private-equity firms have been quietly compounding for decades.

The only difference now? Entrepreneurs like you can play the same game.

1 — The Spread You Can Capture

In the lower-middle-market, companies earning roughly $1M to $20M a year, valuations vary dramatically.

Professionally managed platforms sell for seven or eight times earnings.

Owner-operated companies with no systems, no automation, and one exhausted owner running the show often sell for just three to five times.

That’s your arbitrage. You’re not betting on market timing. You’re betting on better management.

2 — The Simple Four-Step Framework

First, buy a platform, a clean, system-ready business with good strong operators that can absorb others. Next, acquire smaller, owner-run add-ons at three to five times EBITDA.

Then, integrate fast.

Automate workflows.

Standardize software.

Centralize purchasing.

Finally, repackage and sell the group as a professionalized platform that commands nine to eleven times EBITDA.

That’s the spread. And it’s how you turn operational discipline into exponential value.

3 — The Three Margin Levers That Do the Work

Automation & Tech Enablement. Replace manual quoting, scheduling, and billing with software like Jobber, Zoho One, or Housecall Pro.

That single move can add two to four percent to your margins…Industry-Standard Software.

Implement enterprise-grade systems such as ServiceTitan for home services, NetSuite for distribution, or Katana for manufacturing. That adds another three to five points through pricing discipline and real-time visibility.

Procurement & Vendor Consolidation. When you unify purchasing across all companies, vendors sharpen their pencils.

Two to four percent of cost savings falls straight to the bottom line, plus you free up cash tied in inventory.

Three simple levers. Massive compounding effect.

4 — A Hypothetical Roll-Up Example

Imagine this scenario:

You buy a platform generating eight million in EBITDA at about seven times earnings, roughly $56M in enterprise value.

You add four smaller, owner-run companies that together generate another $7M, acquired around four times EBITDA.

Once you integrate them and apply the three levers, combined EBITDA climbs to $15M within twenty-four months.

Sell the entire group at ten times, and you’ve just created a company worth $150M dollars.Your blended entry multiple was roughly six-and-a-half.

That’s a thirty-five to forty-five percent annualized return, without chasing growth hype or risky leverage. Try getting that from a money market account!

5 — The Execution Path

Define your buy box, industry, size, and geography.

Secure smart financing using SBA 7(a) loans, seller notes, earn-outs and creative earn-in structures.

Document your operating system before the first deal closes.

Hire your integration team early, operations, finance, and tech.

Target companies that are system-light and process-poor.

Measure improvements in margin, cash flow, and recurring revenue after each integration.

And when the portfolio runs smoothly, prepare for exit with clean financials, recurring contracts, and management depth.

That’s what buyers pay for.

6 — Why It Works Right Now

Debt markets are still open.

SBA financing covers up to ninety percent of acquisition costs. And private-equity firms are paying double-digit multiples for platforms that already look institutional.

That window won’t stay open forever. As automation spreads, those three-times owner-runs you can buy today will trade at six tomorrow.

7 —The Operator’s Mindset

You’re not buying companies — you’re buying inefficiency. You’re selling professionalism. You’re capturing the value in between. Buy chaos at three times, add structure and sell certainty at ten.

That’s the real roll-up math of 2025/2026. And it’s the playbook every smart operator should be running today.

P.S. Special Announcement

After 5 years of teaching entrepreneurs how to build, buy, and sell companies, I'm retiring all Epic courses and educational content permanently.

This isn't because they didn't work, thousands have built real wealth with these frameworks, but because AI, capital markets, and collaboration have changed the game. I'm shifting from teaching deals to doing deals. Want access to everything before it disappears forever?

This is your last chance to grab 5 years of proven frameworks, strategies, and training materials before they're gone for good. See the full story and whats going into the vault here: Go to the vault

Behind the Scenes on Instagram

Want more than just the weekly deep dives? On Instagram we share quick tips, behind-the-scenes looks, and first access to what’s coming next.

📲 Follow @RolandFrasier on Instagram and join the community.

Thinking About Exiting Your Business?

You’ve built something incredible, now it’s time to make sure you get the most from your exit. We’ve helped countless entrepreneurs maximize their business sales, ensuring they walk away with more than just a deal, they walk away with the best deal possible.

Want to see what’s possible for you? Schedule a complimentary call (click here) today to see how I can help you get the most out of your exit.

Whats Going On

Recently On The Business Lunch Podcast: In this episode we discuss the recent transition from Epic Network to a more focused approach with the Scalable Company. We explore the challenges of running a business that has taken on a life of its own, the importance of making changes when a business no longer serves its founders, and the evolving landscape of course creation in the age of AI. — Listen on Apple Podcasts I Spotify

Keep More Of Your Money: PRIME can show you how to protect yourself, grow assets, build business funding, and how to take advantage of 250+ unique tax deductions. Schedule Your Strategy Session Here

Your Weekly M&A Coaching Call: Every week, I’m breaking down your toughest acquisition questions with actionable advice you can apply now. Watch the latest coaching call below.

The Riff

"I want equity but DON'T want ownership"….Here's the play, tell them: "You keep 100% ownership. I just want to share the upside."

Use: → Phantom Stock (corps), → Profits Only Interest (LLCs)

No voting rights ❌ No cap table changes ❌ No control ❌

Just a contract for exit participation. The owner stays in charge. You get paid on the win. It’s "Consulting for Equity" without the ownership drama.

This is how you align interests without scaring sellers. 🤔 Watch to learn more